Made in Oregon: A Profile of the State’s Manufacturing Sector

May 03, 2024Oregon-made products have secured a spot on store shelves around the country, and even the world. Some of these products have obvious Oregon roots, tasty things like marionberry jam, cheese, fine wines, and beers that say ‘Oregon’ right on the label. Some Oregon-made products remain out of view, however. For example, components in the device you’re reading this article with might have been made right here in Oregon. Whether you can see it on the label or not, Oregon’s manufacturing sector produces products ranging from basic wood pellets to precise aerospace parts. The diverse sector is a fundamental component of the state’s identity.

A manufacturing establishment is defined as an establishment that mechanically, physically, or chemically transforms material, substances, or components into new products. In 2022, Oregon was home to 6,786 manufacturing establishments, providing the state with 192,100 jobs or 9.9% of total payroll employment.

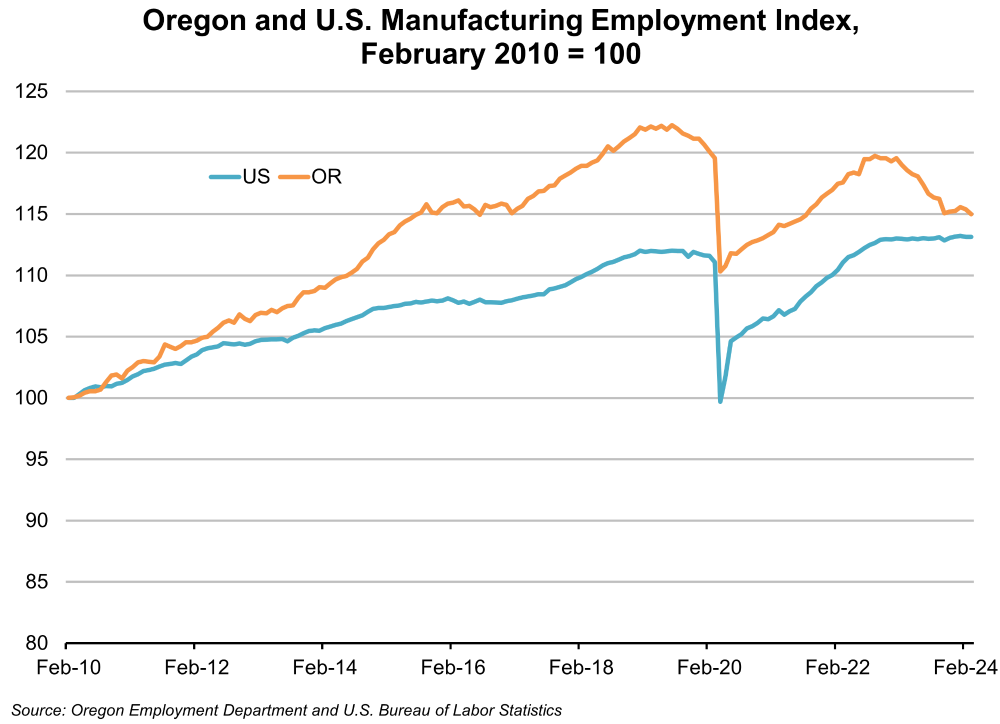

Manufacturing has a slightly larger than average footprint in Oregon (9.9% of employment compared with 8.4% nationally) and is growing more quickly over the long term than the nation. Manufacturing, like other industries, was negatively impacted by the pandemic recession. While Oregon had gained back most of the manufacturing jobs lost due to the recession, employment is still below its 2019 peak and declined for much of 2023. Since its lowest employment level in February 2010 (which the United States reached again in April 2020), manufacturing employment in Oregon has grown by 15% compared with the nation’s 13%.

Despite outperforming the U.S. in terms of long-term growth, Oregon has recently suffered relatively sharper declines in manufacturing employment since January 2019 that continued during the COVID-19 pandemic. Though there had been substantial recovery through 2022, employment in Oregon’s manufacturing sector declined by 6% while U.S. manufacturing has grown by 1% compared with the January 2019 level.

Average wages in Oregon’s manufacturing sector have climbed steadily over the past two decades as the state made the shift from a more natural resource-based manufacturing sector to a center for high-tech manufacturing. In 2022, the average annual wage for manufacturing in Oregon was about $83,300. This far exceeded the state’s average wage of $66,300.

Looking deeper into Oregon’s manufacturing wages, this difference is largely attributable to wages in the computer and electronic product manufacturing industry, which paid an annual average of about $150,400 in 2022. Excluding computer and electronic product manufacturing, Oregon’s average wage across manufacturing industries was about $65,500, slightly below the state’s average.

Oregon’s Specialties

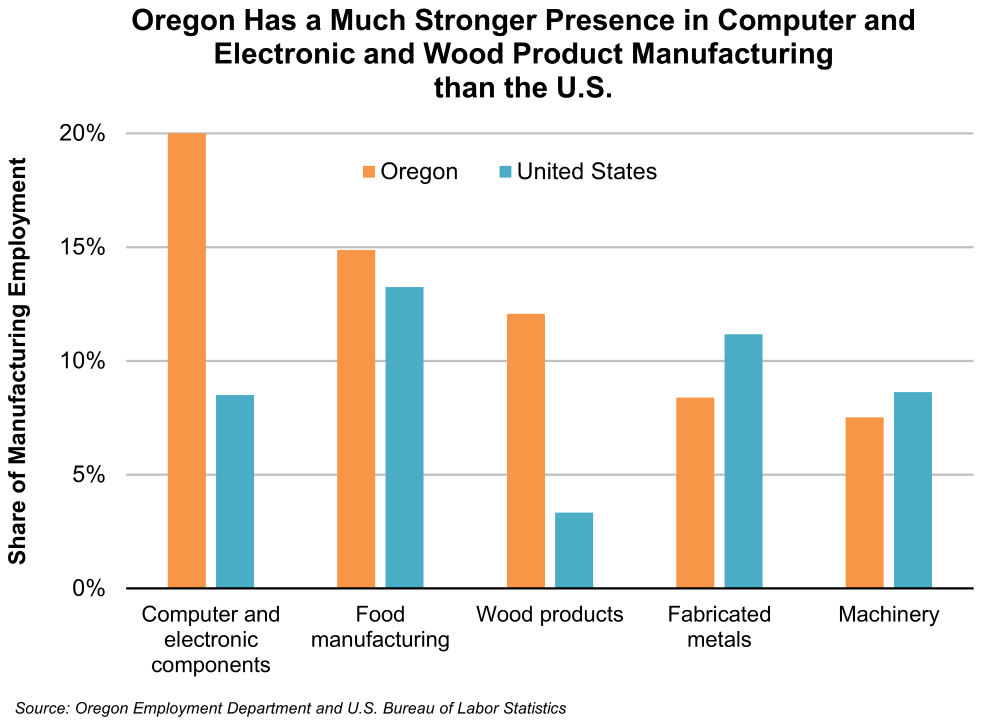

Oregon’s manufacturing sector looks very different than it does nationally. Computer and electronic components manufacturing comprises 21% of the sector statewide compared with about 9% of national manufacturing employment. Wood product manufacturing also has a strong presence in Oregon, making up 12% of sector employment compared with 3% of the sector nationally.

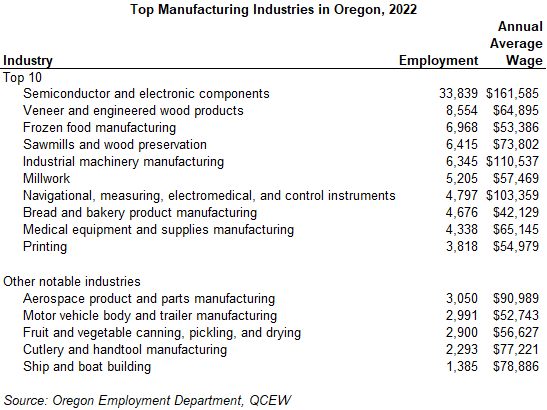

A more detailed industry analysis shows just how diverse the manufacturing sector is. The largest detailed industry by far is the semiconductor and electronic components industry (33,800 jobs in 2022). It also pays far more on average than any other manufacturing industry at $161,600 compared with $83,300 across all manufacturing sectors.

True to Oregon’s long history in forestry, three of Oregon’s top industries are tied to our natural resources: veneer and engineered wood products (8,600 jobs), sawmills and wood preservation (6,400 jobs), and millwork (5,200 jobs). While employment in wood product manufacturing is but a fraction of what it was a few decades ago, these three industries combined play an influential role in Oregon’s manufacturing sector.

Two relatively low-paying industries in the top 10 largest manufacturing industries are frozen food manufacturing ($53,400), and bread and bakery product manufacturing ($42,100). While these industries make up a large chunk of Oregon’s manufacturing sector, the jobs paid average annual wages considerably lower than the statewide average wage of $66,300.

Oregon is well-known across the country for its fresh produce. The number of food preservation businesses, specifically the canning, pickling, and drying of fruits and vegetables, has grown across the state substantially over the years. Employment has risen steadily over the years, and is highly seasonal due to employment spikes around harvest time, though there has been less fluctuation in the past seven years. The annual average wage for fruit and vegetable canning, pickling, and drying is $56,600.

Another notable industry in Oregon is the motor vehicle body and trailer manufacturing industry. This industry includes recreational vehicle manufacturers. Prior to the recession in 2007, this industry peaked at 4,800 jobs. After suffering massive losses during the recession, the industry was left with less than 2,000 jobs. Since then, employment has rebounded and steadily climbed to around 3,000 jobs.

For more information on detailed industries, visit QualityInfo.org where information is published on 125 detailed Oregon manufacturing industries.

Long-Term Aging of the Mostly Male Workforce

The share of manufacturing workers by gender has remained unchanged for the past 20 years, at about 73% men and 27% women. Overall in 2022, women accounted for 47% of Oregon’s private-sector workers; that share also hasn’t changed much since 2001, but it is of course more balanced with women’s share of the population.

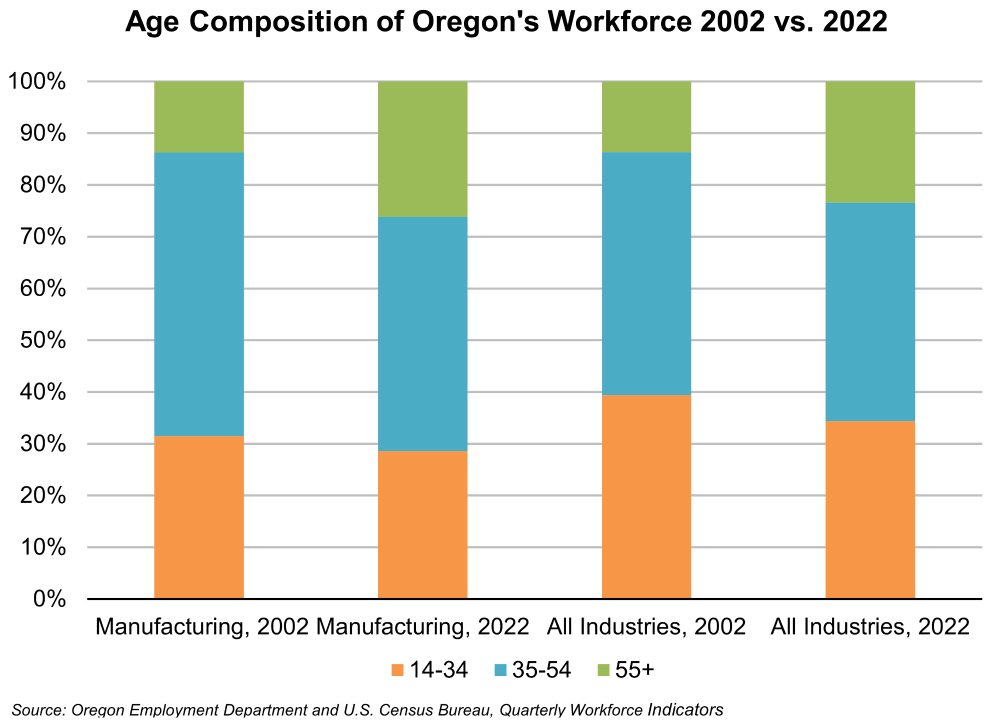

The manufacturing workforce in Oregon is older and aging slightly quicker than the workforce as a whole. Twenty years ago in 2002, 39% of Oregon’s workforce was between 14 and 34 years old. In manufacturing, about 32% of workers were between 14 and 34 years of age. In 2022, only 34% of the workforce was between 14 to 34 years old, while in manufacturing just 29% of workers were in this age group.

The share of workers ages 35 to 54 in manufacturing has declined by 10 percentage points compared with 20 years ago. In the overall workforce, this group’s share has declined by 5 percentage points over the past 20 years.

In both the overall workforce and the manufacturing workforce, workers in the 55 and over age group continue to make up a larger share now that the youngest baby boomers are turning 60. However, the manufacturing workforce has not had as many young workers enter the industry, as is the case for the overall workforce.

As workers retire, these positions will need to be filled by workers who have less experience in the field. This is true for both the overall workforce and the manufacturing workforce but is more pronounced for the manufacturing workforce as fewer young workers have joined.

Projections Show Many Future Openings

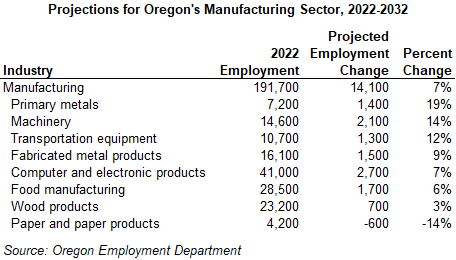

The Oregon Employment Department projects that the state’s manufacturing sector will grow by 7% between 2022 and 2032. Within manufacturing, primary metals manufacturing is expected to grow quickest at 19%. The only broad manufacturing industry expected to lose employment is paper manufacturing.

Manufacturing is expected to grow by 14,100 jobs between 2022 and 2032. In addition to these job gains, there will be many more job openings due to the need to replace workers who leave manufacturing jobs, most of them ending their careers and retiring. Manufacturing may be anticipated to grow at a slower rate than the overall economy in coming years, but as the workforce continues to age there will be lots of job opportunities in the manufacturing industry of the future.

Production occupations with the most projected annual job openings include assemblers and fabricators (1,250); inspectors, testers, sorters, samplers, and weighers (820); packaging and filling machine operators and tenders (810); and first-line supervisors (780). Many high-demand manufacturing occupations typically require a high school education at the entry level. Postsecondary training can make job seekers more competitive for today’s manufacturing jobs.

Conclusion

Oregon’s manufacturing sector has experienced faster long-term growth than manufacturing across the nation. The state’s manufacturing sector has suffered relatively heavier losses leading up to and during the initial months of the COVID-19 pandemic and has yet to recover all jobs lost. However, 7% growth is projected from 2022 to 2032, and many job opportunities will be available as new jobs are created and workers leaving their current occupations are replaced.