Per Capita Personal Income in Eastern Oregon’s 7,000 Club – 2022

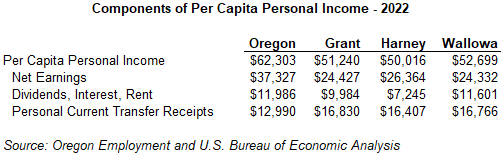

February 22, 2024The Bureau of Economic Analysis publishes county level personal income data. Personal income has three main components: net earnings (wages, salaries, employer contributions); personal current transfer receipts (retirement, Medicare, unemployment insurance); and dividends, interest, and rent. A county’s total personal income is the sum of all income generated by each resident of the county. Dividing total personal income by total population produces per capita personal income (PCPI): the average income per resident regardless of age. This doesn’t actually tell us how much income the average resident receives. However, much the same as per capita GDP, per capita personal income provides a way to make economic comparisons with other areas. It can also highlight trends and changes that warrant further study.

Grant, Harney, and Wallowa counties have populations of similar size. In 2022, there were between 7,200 and 7,700 residents in each of the three Eastern Oregon counties. Wallowa ranked 31st, Harney ranked 32nd, and Grant ranked 33rd in terms of total population among Oregon counties. In terms of PCPI however, Wallowa ranked 19th in 2022 while Grant ranked 25th and Harney ranked 27th.

Wallowa County

Wallowa County’s PCPI fell to $52,699 in 2022, a decrease of 0.6% over the previous year; adjusting for inflation brings the loss to 7.8%. Less than half (46.2%) of Wallowa’s PCPI came from net earnings. Transfer receipts (31.8%) was the second largest portion, with dividends, interest, and rent (22.0%) bringing up the rear. The county ranked 28th in the state for per capita net earnings and 23rd for growth in per capita net earnings from 2012 to 2022. Per capita net earnings increased 4.9% for the county since 2021 but decreased after adjusting for inflation (-2.7%).

Wallowa’s per capita transfer receipts ($16,766) ranked ninth in the state. Per capita transfer receipts decreased by 9.0% since 2021. Retirement and disability insurance benefits accounted for 36.8% of Wallowa’s income from transfer receipts. Nearly all of this was from social security (97.9%). The largest portion (41.7%) of transfer receipts came from medical benefits: 58.5% from Medicare and 41.0% from public assistance medical care. Veterans’ benefits accounted for 7.5% of total transfer receipts and income maintenance benefits accounted for 6.8%.

Wallowa’s per capita dividends, interest, and rent ($11,601) ranked 10th in the state. Per capita dividends, interest, and rent grew by 38.5% for the county from 2012 to 2022. Wallowa was 22nd in the state for growth in this component for the period. Per capita dividends, interest, and rent increased 2.0% since 2021.

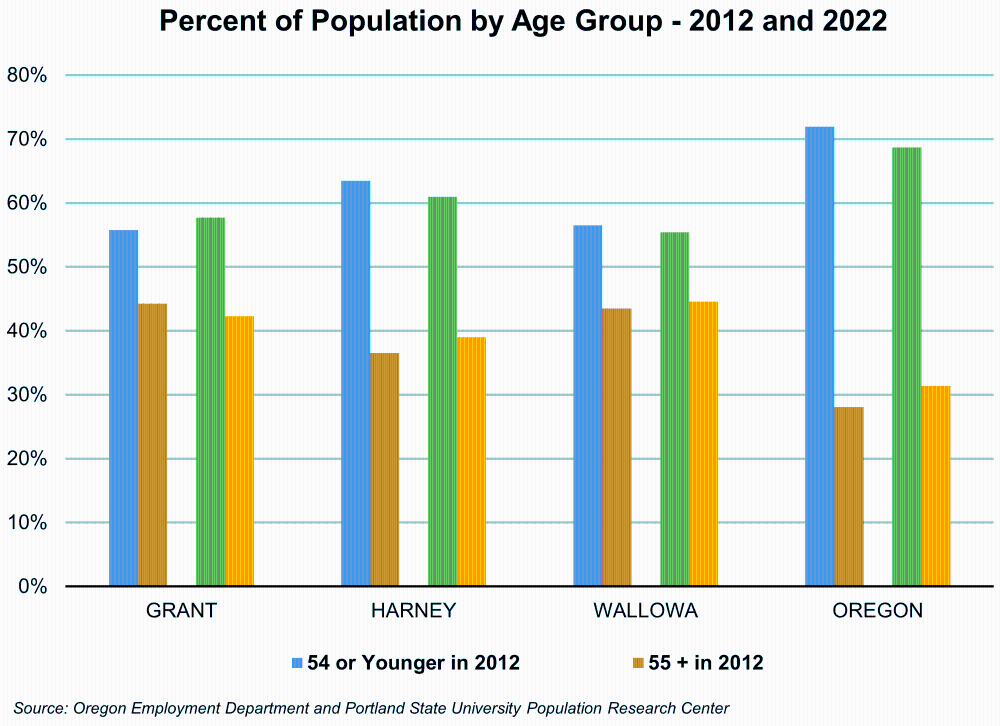

Growth or loss in components of per capita income comes from several factors. Shifting age demographics play a key role for a county. While Wallowa’s total population increased by 7.5% from 2012 to 2022, the 55- to 64-year-old population decreased by 14.2%. This translates to a loss of 183 people for the age group. The prime working age group only added 110 people (4.8%). The 65 or older population, on the other hand, expanded the most during the ten-year period. Growth for the age group was 28.1% and the group picked up 494 people. Counties with a heavy share of older residents are likely to see a larger portion of income drawn from retirement benefits and assets such as stocks, investment accounts, and real estate. For Wallowa, the number of young residents who draw less income from dividends, interest, and rent increased at a much slower rate, while the number of older residents who draw more income from this component increased more rapidly. As a result, per capita dividends, interest, and rent felt upward pressure and saw continued growth for the ten-year period.

Grant County

Grant County’s PCPI rose to $51,240 in 2022, an increase of 0.8% over the previous year; adjusting for inflation changes the gain to a loss of 6.5%. Less than half (47.7%) of Grant’s personal income came from net earnings, with the second largest portion (32.8%) from transfer receipts. The county ranked 27th in terms of per capita net earnings in 2021, but 13th for growth in per capita net earnings from 2012 to 2022. Per capita net earnings increased by 7.1% for the county since 2021, or -0.7% adjusted for inflation.

Grant County’s per capita transfer receipts ($16,830) ranked eighth in the state. Per capita transfer receipts decreased 8.0% since 2021. A large portion (34.5%) of income from transfer receipts was in retirement and disability insurance benefits; 97.8% of this was from social security. The largest portion of transfer receipts (44.1%) came from medical benefits: 56.5% from Medicare and 43.2% from public assistance medical care. Income maintenance benefits accounted for 8.2% of total transfer receipts and Veterans’ benefits accounted for 6.9%.

Grant’s per capita dividends, interest, and rent ($9,984) ranked 15th in the state. This component grew 37.0% from 2012 to 2022. Grant County was 23rd for growth in per capita dividends, interest, and rent for the 10-year period. Deschutes County showed the most growth (+85.9%), while Malheur County showed the least growth (+12.1%). Per capita dividends, interest, and rent increased by 2.6% for Grant since 2021.

Grant’s total population decreased by 1.5% from 2012 to 2022. All the loss was seen in the 18- to 64-year-old portion of the population, which decreased by 32.7% or 1,304 people. The 18 to 24 age group fell by 27.8%, the 25 to 54 age group fell by 32.9%, and the 55 to 64 age group fell by 44.3%. Meanwhile, the 17 and younger population jumped by 71.9%, gaining 979 people, and the 65 and older population increased by 21.0%. Grant residents aged 55 or older represented over two-fifths of the county’s population in 2022 and those at or above retirement age represented almost one-third of the population. Like Wallowa, per capita dividends, interest, and rent for Grant County felt upward pressure and saw continued growth for the ten-year period.

Harney County

Harney County’s PCPI rose to $50,016 in 2022, an increase of 1.6% from the previous year; adjusting for inflation changes the gain to a loss of 5.7%. Over half (52.7%) of Harney’s PCPI came from net earnings with the second largest portion from transfer receipts (32.8%). The county was 20th in per capita net earnings, but fourth in growth for per capita net earnings from 2012 to 2022. Per capita net earnings increased by 7.6% for Harney since 2021, or -0.2% when adjusted for inflation.

Harney County’s per capita transfer receipts ($16,407) ranked 15th in the state. Per capita transfer receipts decreased by 7.0% since 2021. For Harney, a smaller portion of income from transfer receipts (30.0%) was seen in retirement and disability insurance benefits, although a comparable 97.2% of this was from social security. The largest portion of transfer receipts (47.4%) came from medical benefits: 56.1% from Medicare and 43.7% from public assistance medical care. Income maintenance benefits accounted for 9.5% of total transfer receipts and Veterans’ benefits accounted for 6.8%.

Harney’s per capita dividends, interest, and rent ($7,245) ranked 30th in the state. Per capita dividends, interest, and rent grew by 18.3% from 2012 to 2022. Harney County was 33rd for growth in this component for the period. Per capita dividends, interest, and rent increased by 2.4% for Harney since 2021.

Harney’s total population increased by 4.4% from 2012 to 2022. The prime working age (25 t0 54) population saw the slowest growth (+3.4%) among the age groups adding people. The 55 to 64 age group decreased by 109 people (-9.2%) and the 17 or younger group dropped by 112 people (-7.0%). The 65 and over age group grew the fastest over the period, increasing by 28.1% or 418 residents. The county’s residents aged 55 or older accounted for 39.0% of the population in 2022; residents 65 or older accounted for one-fourth of the population. As with Wallowa and Grant, Harney also felt upward pressure on per capita dividends, interest, and rent and saw continued growth in the component for the ten-year period.

The Sum of Things

Grant, Harney, and Wallowa have similar size populations, but different levels of PCPI. The three counties draw nearly the same percentage of income from transfer receipts. Harney, which has the largest 18 to 54 population, draws the highest percentage of income from net earnings. Grant, which has the smallest 18 to 54 population, draws more from net earnings than Wallowa. All three counties have seen continued growth in dividends, interest, and rent in line with shifts in age demographics. Grant has the largest 65 or older population among the three counties while Harney has the smallest. However, Wallowa draws the highest percentage of income from dividends, interest, and rent.