Wage and Job Growth Across Many Industries

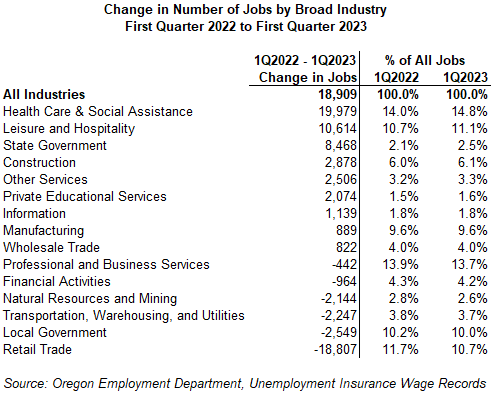

March 7, 2024Oregon had 1.98 million people working in jobs covered by the state’s unemployment insurance system during the first quarter of 2023. This was an increase of 21,700, or 1.1%, from the same quarter of the previous year. They earned a total of $33.4 billion, with an average wage of about $16,800 per worker for the quarter. The median hourly wage during the quarter was $26.52.

Wage Growth in Several Industries Despite Inflation

Oregon employers reported over 2.1 million jobs during the first quarter of 2023. The vast majority of Oregonians (90.1%) held one job during the quarter. Approximately 8.8% of workers in the first quarter of 2023 held two jobs, 1.0% of workers held three jobs, and 0.2% of workers held four or more jobs. This looks similar to a year before in the first quarter of 2022.

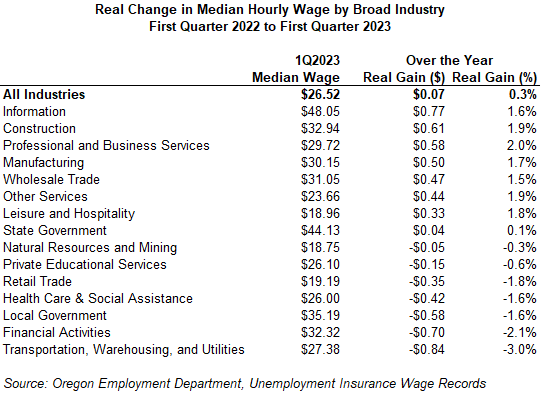

Meanwhile, the median wage increased by $0.07 over the year, after being adjusted for inflation according to the Consumer Price Index for All Urban Consumers (CPI-U). Strong inflation over the past few years has translated to fewer industry wages keeping up in their real purchasing power.

Eight industries had real wage gains, meaning that the median wage increased more than inflation: information, construction, professional and business services, manufacturing, wholesale trade, other services, leisure and hospitality, and state government. Professional and business services had the largest real gain in median wage percentage growth from first quarter 2022 to first quarter 2023 (2.0%). However, a handful of industries had decreases in real median wage. Transportation, warehousing, and utilities jobs had the biggest decrease in both real percentage change (-3.0%) and the real dollar value decrease (-$0.84).